Protect what matters most — Without Overpaying.

Affordable term life insurance designed to give your family financial security when they need it most. Get the coverage you want for the time that you need at a price that fits your budget.

-

100% Online Experience that takes as little as 10 minutes to complete. A simple online application to answer questions about your age, health, medical history and lifestyle.

-

Up to $2 million in coverage and up to 30 years of term length. You can easily select the policy that is right for you. If you are not sure, you can make adjustments after you get approved. If you are not sure how much coverage you need, we can help!

-

Once you submit the application, it will be processed in real time and often, you’ll get an instant decision. You can activate coverage immediately.

-

The answers to your health question are enough for us to provide you with an accurate quote.

A simple way to save on the cost of life insurance.

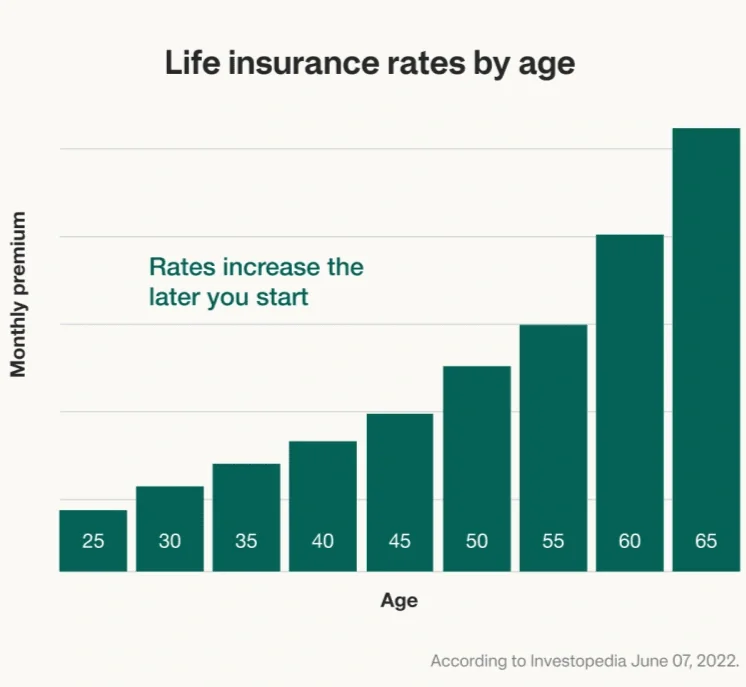

Getting life insurance coverage early, often means getting your best rate. The cost of life insurance can increase every year you wait to get covered. The moment you activate your policy, you lock in your rate and it won’t change for the full length of your term.

Common mistakes when buying life insurance

Waiting until you have children.

Many people are waiting until later in life to start families. If you’re one of them and you delay buying life insurance until you have children, it could cost you the opportunity of locking in a low premium. Even if you don’t yet have children to protect, life insurance can cover your personal debts, medical bills, home mortgage, lost wages, and even funeral expenses. This can help take the financial burden off of your partner or another next of kin – and later on, your future children.

Relying on Employer-Sponsored Coverage.

Employer-provided life insurance is a nice benefit, but these policies rarely offer sufficient coverage. Employer-sponsored policies typically only provide coverage of one to two times your annual salary. However, financial experts recommend you carry coverage about 10 times your salary.The other complication is that if there is any change to your employment status (such as retirement, layoff, or job change), it likely means you’ll lose the policy. If this job status change occurs when you're older—or after you've developed a health issue—it could be more expensive and difficult to secure new coverage. Having your own policy helps protect you and your loved ones against life’s unexpected changes.

You assume you’ll remain in good health for a long time.

Your health status is one of the most crucial factors when determining term life insurance rates. The healthier you are, the less you pay, so getting life insurance at a younger age can be advantageous. As you age, the risk of developing health issues (such as cancer or diabetes) increase, and can lead to higher premiums and sometimes even make it difficult to get coverage. Securing life insurance earlier in life helps protect you—and those who depend on you—against any unexpected changes in your health.